Are you trying to make changes to your finances? If so, you have come to the right place. There are some easy steps that you can take now to improve your financial situation in 2022. In this article, you’ll learn how to set up a budget, build an emergency fund, and keep track of your frivolous spending habits. If you’re unsure of where to begin, follow these steps to make your finances better than ever!

Budgeting

With the holidays around the corner, it’s time to think about your financial future. According to a survey by WSFS Bank, four out of 10 Americans plan to increase their savings this year. But what about those who have debt? Is it time to turn a new leaf? A budget can help you reach your financial goals, from saving up for a rainy day to reducing your credit card debt.

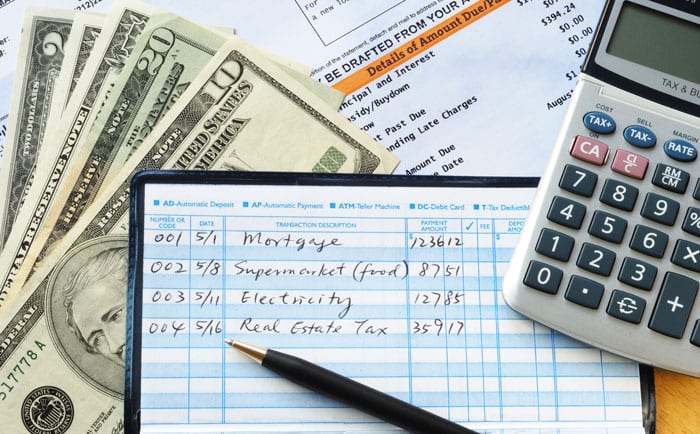

Creating a budget can be challenging, but it can help you regain control of your money. Having a budget is the first step to a healthier money attitude. By making a budget, you can make sure you’re getting the most out of your money. And while budgeting can be daunting, the reward for creating one is worth it. You’ll be glad you did it once you see how easy it is to follow the rules!

Building an emergency fund

Saving money for an emergency fund is essential for your financial well-being. During times of unforeseen expenses, emergency funds can be the difference between survival and disaster. While your emergency fund is likely stored in a low-yield vehicle, it is important to save a little extra each month to avoid the stress of unexpected financial crisis. Ideally, you should have at least a year’s worth of fixed expenses, and enough to cover variable costs for six months.

A good way to save is by setting up an automatic transfer from your paycheck. Your employer can set this up for you, as can many banks. Set up your emergency fund account to receive automatic deposits from your paycheck. It’s important to set aside money for emergencies, as well as a portion of your paycheck. You should also avoid constantly monitoring the balance of your emergency fund. Constantly checking your account’s balance will inhibit the growth of your savings.

Keeping tabs on frivolous overspending

In the New Year, it’s common to think about setting new financial goals. Unfortunately, bad money habits can keep you from reaching your financial goals, even if they feel good at the time. A monthly budget is an effective way to control your spending, train your brain to prioritize, and reduce unnecessary spending. Here are some tips for getting started:

To begin tracking your spending habits, create a budget and review your account statements. Divide the total amount you spend each month by 30 days. Set monetary limits for each day of the month. Each day, cut down on spending by a certain percentage and act accordingly. Make it a habit to update your budget as you pay your bills. By doing so, you will be able to recognize situations when you’re going over your spending limits, and take action without going over.

Investing

If you want to improve your finances in 2022, you should start investing sooner rather than later. You can start by cutting out massive retailers. If you’re unhappy with the current state of the stock market, you can look for sustainable investments. While your personal expenditures may not change world operations, the power of your dollar will. In the 2022 stock market, you should be careful not to pull your money out too soon. Pulling your money from stocks can cause you a lot of money in the process.

You can also automate many of your financial activities. You can set up automatic savings rules in your bank account or auto-pay for monthly bills. There is an old saying, “don’t put all your eggs in one basket.” Investing in various financial instruments will spread your risk. You should diversify your portfolio across different assets. Having more than one asset will make it easier for you to manage your finances.